In the world of boating, many terms and phrases can be a bit tricky to navigate, especially when you’re new to the industry or considering purchasing a vessel. One such term that may cause confusion is “U-boat.” For many, the first association with a “U-boat” might be military submarines from World War II, but in the context of boat financing and recreational boating, the term has a different connotation. Understanding what a U-boat is and how it might relate to boat financing is essential for both boat buyers and sellers, as well as financial institutions like Float Finance, which helps customers finance their dream vessels. Let’s go over what is a U-Boat.

In this article, we’ll explore what a U-boat is in the world of boating, how it differs from other types of boats, and how it could impact financing options. Whether you’re looking to purchase a U-boat or just want to understand the terminology better, we’ve got you covered.

What Is a U-Boat?

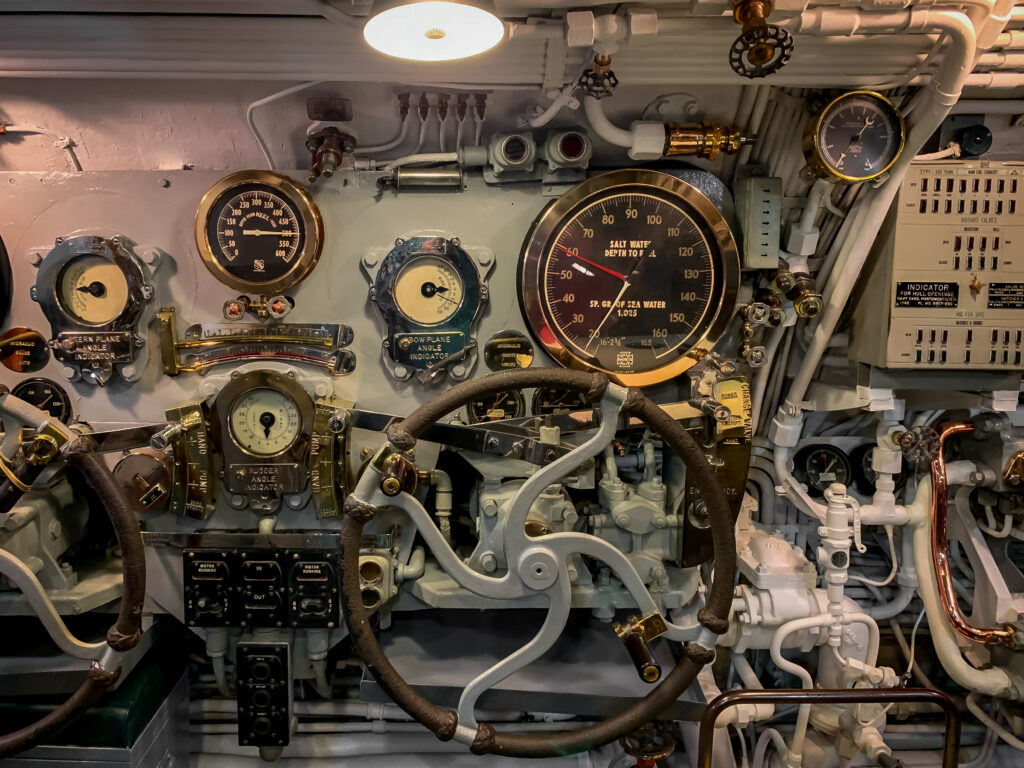

A U-boat, in the boating world, generally refers to a small, private submarine designed for underwater exploration or recreational use. It’s important to note that while the term “U-boat” may have historical significance due to its military use, modern U-boats are primarily used for leisure activities or commercial purposes, such as underwater tourism.

Unlike larger commercial or military submarines, which are designed for extended underwater missions, U-boats in the recreational boating space are more compact, designed for shorter excursions or as luxury toys for the wealthy. These vessels are capable of diving to various depths, allowing users to explore the ocean or other bodies of water in a way that’s not possible with traditional boats.

History of the U-Boat

The term “U-boat” comes from the German word “Unterseeboot,” meaning “undersea boat.” During World War I and World War II, German U-boats were used as military submarines, primarily for attacking enemy ships and disrupting supply lines. These submarines were designed to submerge and operate underwater, making them incredibly effective in naval warfare. Over the years, the military U-boat became an iconic symbol of naval warfare, particularly in the context of WWII, where it played a central role in both the Allied and Axis forces’ strategies.

However, the recreational U-boat is a completely different concept. Modern-day U-boats are typically not armed and are designed solely for exploration and leisure. As advancements in marine technology have allowed for more compact and affordable designs, private individuals, luxury yachts, and even tour companies have begun using small U-boats for underwater experiences.

Types of U-Boats

While all U-boats are designed to go underwater, there are various types of recreational and commercial U-boats, each with different capabilities, uses, and features. The two main categories of U-boats are:

1. Private Submarines

Private U-boats are compact submarines designed for private owners who wish to explore the depths of the ocean or enjoy underwater leisure. These vessels can range from small, two-person submarines to larger models capable of accommodating families or small groups. Private U-boats are often luxurious, featuring comfortable interiors with windows for observing marine life.

Key Features of Private U-Boats:

- Compact Size: Small enough to be stored in a marina or yacht garage.

- Luxury Design: Many private U-boats are designed with comfort in mind, offering air conditioning, seating, and high-end finishes.

- Underwater Capability: Typically able to dive to depths ranging from 100 feet to over 1,000 feet, depending on the model.

- Personalized Features: Some private U-boats offer customizable options, such as multi-vision windows, dive computers, and sonar systems for navigation and safety.

2. Tourism or Commercial Submarines

Commercial U-boats are larger vessels designed for tourism or research purposes. They are typically used to take passengers on guided underwater excursions, allowing them to experience marine life in a way that traditional boats cannot. These U-boats are built with safety in mind and are often equipped with robust systems for navigation and communication.

Key Features of Commercial U-Boats:

- Larger Capacity: Can carry anywhere from 10 to 50 passengers.

- Safety Features: Equipped with multiple life support systems, emergency oxygen, and advanced navigation and communication equipment.

- Tourist Attraction: Used in destinations like the Caribbean or other coastal regions where marine tourism is popular.

- Stable Construction: Designed to operate in deep waters for extended periods, often diving to depths of several hundred feet.

The Growing Popularity of U-Boats in the Luxury Market

As luxury items become more accessible and as technology continues to improve, private U-boats are becoming more popular among wealthy individuals who seek unique and exclusive experiences. Whether as an addition to a superyacht or as a standalone luxury purchase, private U-boats are no longer reserved for deep-sea exploration missions. The ability to explore the ocean at depths that were once only accessible to researchers or military personnel is a draw for high-net-worth individuals.

These U-boats are seen as a status symbol for some, providing not only an incredible adventure but also a unique way to engage with the natural world. Many of these private submarines are equipped with advanced features like large observation windows, deep-sea cameras, and climate control systems to ensure maximum comfort during dives.

In addition to the luxury market, U-boats are also seeing increased use in marine tourism. In some coastal areas, businesses have begun offering underwater tours using commercial U-boats, allowing tourists to experience marine life up close. This development has expanded the market for U-boats, making them a unique attraction for high-end travel experiences.

U-Boats and Financing

For customers interested in purchasing a U-boat, the price can be a significant consideration. U-boats are often very expensive, particularly private models that offer luxurious features and deep-sea capabilities. As a result, financing options may be necessary for those looking to buy a U-boat.

Float Finance, a leading boat financing provider, can play a crucial role in helping buyers secure the funds they need to purchase a U-boat. Similar to other boats and luxury yachts, U-boat financing works through loans that allow the buyer to make monthly payments over a set period. However, because of the high cost and specialized nature of U-boats, the financing process may be slightly more complex than traditional boat financing.

Here are a few considerations for financing a U-boat:

1. Cost of a U-Boat

U-boats can be expensive, with prices often starting at $1 million or more for a private submarine. Some luxury models can easily exceed $10 million. This means that traditional boat loans may not be sufficient to cover the cost. Buyers will need to ensure they are financially prepared for the investment and can manage the monthly payments.

2. Collateral

Because U-boats are high-value items, securing financing for one may require the buyer to offer collateral. The U-boat itself will often be the collateral for the loan, meaning that if the borrower fails to make payments, the lender (such as Float Finance) may seize the U-boat to recover the outstanding debt.

3. Interest Rates

Interest rates on U-boat financing may be higher than typical boat loans due to the risk involved in financing such a high-value item. However, buyers can shop around for the best rates and terms. Float Finance offers specialized loans for luxury items like U-boats, with flexible terms and competitive rates.

4. Down Payment

For a large purchase like a U-boat, a significant down payment is often required. This can range anywhere from 10% to 30% of the purchase price. The down payment helps reduce the overall loan amount and shows the buyer’s commitment to the purchase.

5. Custom Financing Plans

Given the unique nature of U-boats, Float Finance may work with buyers to create custom financing plans. These plans could include longer loan terms, customized repayment schedules, and even the ability to refinance the loan in the future.

How Float Finance Can Help Buyers of U-Boats

For buyers considering purchasing a U-boat, Float Finance provides valuable services to ensure that the process goes smoothly. Here’s how Float Finance can help:

1. Expert Guidance

Float Finance can guide buyers through the complex financing process, offering expert advice on loan options, terms, and down payments. This ensures that buyers make informed decisions and choose the best financing option for their needs.

2. Specialized Loans

Given the high cost of U-boats, Float Finance offers specialized loans that cater to the luxury boat market. These loans can be customized based on the buyer’s financial situation and the specific requirements of the U-boat they are purchasing.

3. Competitive Rates

Float Finance works with various lenders to offer competitive rates and favorable terms for luxury items like U-boats. With access to multiple lending options, buyers can secure the best possible financing deal.

4. Easy Application Process

Float Finance offers a streamlined application process, making it easy for buyers to apply for a loan and get approved quickly. This is essential for high-net-worth individuals who may want to move quickly when purchasing a U-boat.

Conclusion

A U-boat is an exciting and luxurious addition to the world of recreational boating. Whether you’re looking for a private submarine to explore the depths of the ocean or considering the growing trend of underwater tourism, U-boats offer an unparalleled adventure on the water. For buyers considering a U-boat purchase, financing through Float Finance provides the flexibility, expertise, and competitive rates needed to make such a significant investment. By understanding the nature of U-boats and working with a trusted financing provider, you can make your dream of owning a personal submarine a reality. We hope this helps you understand what is a U-Boat.